ENVIRONMENTAL

Vision 2030*

VORNADO'S COMMITMENT TO CARBON NEUTRALITY

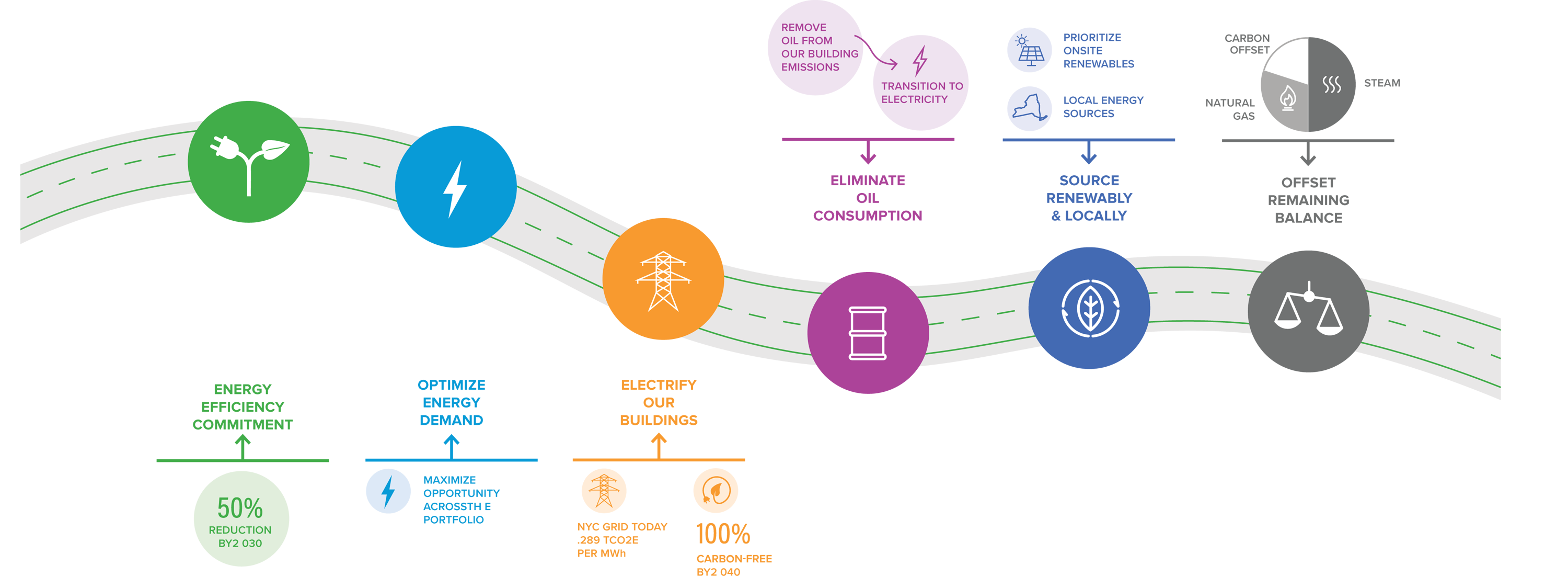

Vision 2030 is our commitment to reach carbon neutrality through a combination of emissions reductions and offsets from our buildings. We will rely on both existing and future technology, as well as meaningful stakeholder collaboration with our tenants, our employees, and our communities. In 2021, we made a SBTi commitment to reduce our Scope 1 and 2 emission intensity by 64% per SF by 2030 below a 2019 base year. Our commitment is 1.5°C-aligned, the most ambitious designation offered through the SBTi process.

33%

REDUCTION AS

OF 12/31/21

10MW

DEMAND

RESPONSE IN 2021,

PORTFOLIO-WIDE,

PLUS 6 MW OF

COGENERATION.

7900TONS

COOLING

CONVERTED TO

ELECTRICITY

52,619MBH

PROJECTED

REDUCTION

UPON OIL-TO-ELECTRICITY

REPLACEMENT

215,000MW

MEGAWATT HOURS

OF RENEWABLE

POWERANNUALIZED

SCOPING AND INDICATIVE

PRICING RECEIVED

2030 TARGET COMMITMENTS

2021 PROGRESS

We will reduce our energy consumption 50% below a 2009 base year by 2030. This goal includes both landlord- and tenant-driven consumption. More information on this effort can be found in the Energy Efficiency Targets

section of this report.

33%

REDUCTION AS

OF 12/31/21

CONTINUED IMPROVEMENT, BEHAVIORAL CHANGE

Our energy efficiency work continues to make progress toward our goals through 2021. We continue to monitor changes to our tenants’ use of space as tenants return to our buildings in 2022.

In addition to doing more with less energy, we will shift our energy usage to occur during hours when the electric grid uses cleaner sources of generation. Demand response, demand management, and energy storage will be the primary contributors to this strategy. We also will use building analytics software to more smartly operate our buildings and reduce demand on a permanent basis.

10MW

DEMAND RESPONSE IN 2021,

PORTFOLIO-WIDE, PLUS

6 MW OF COGENERATION.

TECH-DRIVEN SMART BUILDING OPERATIONS

In addition to demand response, in 2021 we installed building management systems that will import real-time occupancy and indoor air quality to enable permanent peak demand management.

We know that a carbon-neutral building must consume energy from 100% renewable sources. As New York State pursues its plan to secure 70% of electricity from renewable systems by 2030 and 100% clean electricity by 2040, we will evaluate opportunities to convert our steam, gas, and oil-sourced consumption to electricity. We will prioritize electricity as our sole source of building energy in all ground-up new development.

7900TONS

COOLING CONVERTED

TO ELECTRICITY

MODERNIZATION OF OUR HVAC

In 2021, we completed the electrification of cooling systems at PENN 1, PENN 2, and 770 Broadway.

We see a path forward to eliminate or modify all our legacy oil boilers to cleaner sources of energy. We will transition these systems to electricity where economically and technologically feasible.

52,619MBH

PROJECTED REDUCTION

UPON OIL-TO-ELECTRICITY

REPLACEMENT

CAPITAL PLANNING FOR BOILER RETROFITS

In 2021, we completed feasibility studies at three of our four active boiler sites in New York City and commenced electrification of heating at 486 Broadway.

We will pursue opportunities to source our supply of electricity from 100% renewable sources while we wait for our grid systems to make their own fully renewable transition. We will prioritize onsite renewable energy production, as well as sources located close to our buildings and cities.

215,000MWH

MEGAWATT HOURS

OF RENEWABLE POWER

ANNUALIZED

A LANDMARK TRANSACTION FOR NEW YORK STATE

In 2021, Vornado procured Renewable Energy Credits that are sourced from hydro energy facilities located in the State of New York. This purchase allowed Vornado to assign zero carbon attributes to 100% of annualized directly procured electricity. These RECs will be retired through the New York Generation Attributes Tracking System (NYGATS).

As we make this transition, we know there will be a remaining balance of energy consumed from fossil fuels. We will augment that balance with carbon offsets until we fully transition to zero-carbon utility consumption.

SCOPING AND INDICATIVE

PRICING RECEIVED

As of December 31, 2021, Vornado has not purchased any carbon offsets to contribute toward Vision 2030. We continue to evaluate opportunities for purchase and to engage with our tenants, our investors, local governments, and other stakeholders to assess whether expediting this approach would align with their priorities toward carbon neutrality.

*Any information relating to forward-looking statements, targets, goals, and progress against goals was not subject to Deloitte & Touche LLP’s review and, accordingly, Deloitte & Touche LLP does not express a conclusion or any form of assurance on such information.

TASK FORCE ON CLIMATE-RELATED FINANCIAL DISCLOSURES (TCFD)*

GOVERNANCE

Vornado became a signatory of the TCFD in February 2019, among the first American real estate companies to endorse the TCFD recommendations and to task leadership with evaluating and disclosing climate related risks. Our Board’s Corporate Governance and Nominating Committee oversees environmental matters, including climate-related risks and opportunities. The Board is part of the top-down strategy on ESG risk management, which includes the execution of TCFDrelated tasks by our Corporate ESG Team, senior management, divisional leaders, and integration throughout all divisions of our business.

The individual responsible for ESG and climate-related objectives is the SVP Sustainability & Utilities Officer. While responsibility for managing climate-related risks is integrated throughout Vornado, the SVP Sustainability & Utilities Officer takes an overarching view of Vornado’s progress and strategy at a corporate level.

Further discussion on our governance around climaterelated risks and opportunities can be found in the ESG Governance section of this report.

GOAL: DISCLOSE THE ORGANIZATION’S GOVERNANCE AROUND CLIMATE-RELATED RISKS AND OPPORTUNITIES

STRATEGY

We have identified IPCC Representative Concentration Pathway (RCP) 2.6 (targeting a 1.5- to 2-degree scenario) as the primary scenario to assess transitional risk and opportunities over the short-, medium-, and long-term horizon, as informed by the regulatory frameworks in the communities where our properties are located. We identify a “business-as-usual” scenario of RCP 6.0 to assess the physical risks of climate change, due to the possibility of failure of global efforts to mitigate, though we are constantly evaluating the potential scale and frequency of the identified risks to inform our Risk Management assessments. The impact of such risks guides strategies for our buildings through acquisition, development or redevelopment, or operations for our stabilized assets. More information can be found in our SASB disclosures on climate change risk.

GOAL: DISCLOSE THE ACTUAL AND POTENTIAL IMPACTS OF CLIMATE-RELATED RISKS AND OPPORTUNITIES ON THE

ORGANIZATION’S BUSINESS, STRATEGY, AND FINANCIAL PLANNING WHERE SUCH INFORMATION IS MATERIAL

RISK MANAGEMENT

We identify and assess physical risks using data models and resources that use both historical and forward-looking climate data to determine potential exposure to climate-related events. We identify and assess transitional risk through analyzing our exposure to local climate regulations.

Where acute physical risk for a property is noted, we manage this risk through measures of climate resilience and adaptation. In 2021 we re-categorized some of our identified physical risks to drive faster action in the face of the increased frequency of these events. Our primary means of managing this risk is through our energy efficiency program, as energy consumption at our properties drives our ability to comply with regulations such as the Climate Mobilization Act (CMA) in New York City.

The costs of energy efficiency work, electrification, and other efforts to comply for each of our buildings are factored into our risk analysis, and we continue to explore other costs associated with short-, medium-, and long-term climate risks. We will forgo disclosure of these costs until compliance requirements for CMA and other climate regulations are more definitively known, although we do not expect these costs to be material.

Our climate risk assessment informs the risk profiles for our properties and is a component of our annual Enterprise Risk Management process. Understanding these risks helps us to better assess potential acquisitions through the due diligence process as well as potential impacts within our redevelopment efforts.

Further discussion on our climate risk assessment is found in the Resilience and Adaptation section of this report, as well as our SASB disclosures on climate change risk.

GOAL: DISCLOSE HOW THE ORGANIZATION IDENTIFIES, ASSESSES, AND MANAGES CLIMATE-RELATED RISKS

METRICS AND TARGETS

Our metrics and targets that most meaningfully help us to assess our climate-related risks and opportunities, as defined in our Risk Management assessment, are reflected in the Energy Efficiency Targets and Environmental Goals and Progress sections of this report. GHG emissions are disclosed in the Environmental Results 2021 section of this report.

To guide Vornado’s efforts to assess and manage climate-related risks, in 2021 Vornado Realty Trust committed to reducing its Scope 1 and 2 GHG emissions to 64% per SF by 2030 from a 2019 base year, in line with a 1.5 C trajectory. The science-based target methodologies considered various scenarios, including an IEA ETP B2DS scenario, and were modeled using the Sector Decarbonization approach applying company-specific growth trajectories to historical GHG emissions trends. The target boundary includes biogenic emissions

and removals from bioenergy feedstocks. As Scope 3 emissions account for less than 40% of total emissions, only Scope 1 + 2 emissions were covered by targets. The analysis provides Vornado with reference points to determine the appropriate plans of action to achieve emissions reductions, such as energy efficiency measures and renewable energy investments.

More information on our climate risk assessment is found in the Resilience and Adaptation section of this report, as well as our SASB disclosures on climate change risk.

GOAL: DISCLOSE THE METRICS AND TARGETS USED TO ASSESS AND MANAGE RELEVANT CLIMATE-RELATED RISKS AND OPPORTUNITIES WHERE SUCH INFORMATION IS MATERIAL

*Any information relating to forward-looking statements, targets, goals, and progress against goals was not subject to Deloitte & Touche LLP’s review and, accordingly, Deloitte & Touche LLP does not express a conclusion or any form of assurance on such information.

*Any information relating to forward-looking statements, targets, goals, and progress against goals was not subject to Deloitte & Touche LLP’s review and, accordingly, Deloitte & Touche LLP does not express a conclusion or any form of assurance on such information.

TRANSITIONAL RISKS AND OPPORTUNITIES:

SCENARIO ANALYSIS - RCP 2.6

SHORT-TERM (1-10 YEARS)

Risks

We identify RCP 2.6 as our short-term transitional scenario, due to the regulations in the cities where we do business, as well as our carbon neutrality goal.

Manufacturing and supply chain disruption could occur.

Opportunities

Our Vision 2030 roadmap outlines the many components required to transition our portfolio to a climate trajectory that aligns with a 1.5-degree climate scenario.

In 2021, we expanded our Vendor Integrity Program (VIP) to assess a wide range of ESG criteria across our value chain. More information can be found in the Supply Chain section of this report.

2030 MEDIUM-TERM

Risks

De-carbonization of grid-supplied energy could lead to increased energy costs and operating expenses for our buildings.

Retrofitting our building systems to consume less energy could lead to increased capital costs.

Fossil fuel consumption, though mitigated through carbon offsets, may be subject to penalties.

Opportunities

Our overall energy consumption could decrease, yielding a reduced operating cost.

Carbon-neutral buildings could be more competitive in the long term and could yield higher value to our business.

Energy storage, onsite renewable energy, and distributed energy resource deployment could yield additional sources of revenue and attract and retain tenants.

2050 LONG-TERM

Risks

Full transition of grid-supplied energy to renewable sources could lead to increased energy costs and operating expenses for our buildings.

Opportunities

Improved air quality could lead to lower HVAC operating and maintenance costs.

Mitigated increases in temperature could lead to reduced costs to adapt our buildings to be resilient to more extreme climate scenarios.

Renewable energy delivered from the grid will reduce source-generated carbon emissions and potentially reduce exposure to climate regulation.

Full transition of grid-supplied energy to renewable sources could lead to decreased energy costs and operating expenses for our buildings.

PHYSICAL RISKS – RCP 6.0

SHORT-TERM

Stormwater surge, flood risk in vulnerable areas.

Localized loss of power.

Degradation of air quality and public health.

Change in workplace behavior and related emissions caused by the COVID pandemic.

Increased extreme weather events and temperature conditions cause increases in building HVAC-related energy and maintenance costs.

MEDIUM-TERM

Increase in disaster relief costs.

Increase in infrastructure and construction costs.

Increase in instances of business interruption.

Increase in insurance premiums.

LONG-TERM

Accelerated increases in land and ocean temperatures could lead to increased climate-related events, including extreme precipitation events, which could yield significantly higher disaster response and flood mitigation costs.

Accelerated increases in sea-level rise could lead to increased damages from coastal urban floods.

*Any information relating to forward-looking statements, targets, goals, and progress against goals was not subject to Deloitte & Touche LLP’s review and, accordingly, Deloitte & Touche LLP does not express a conclusion or any form of assurance on such information.

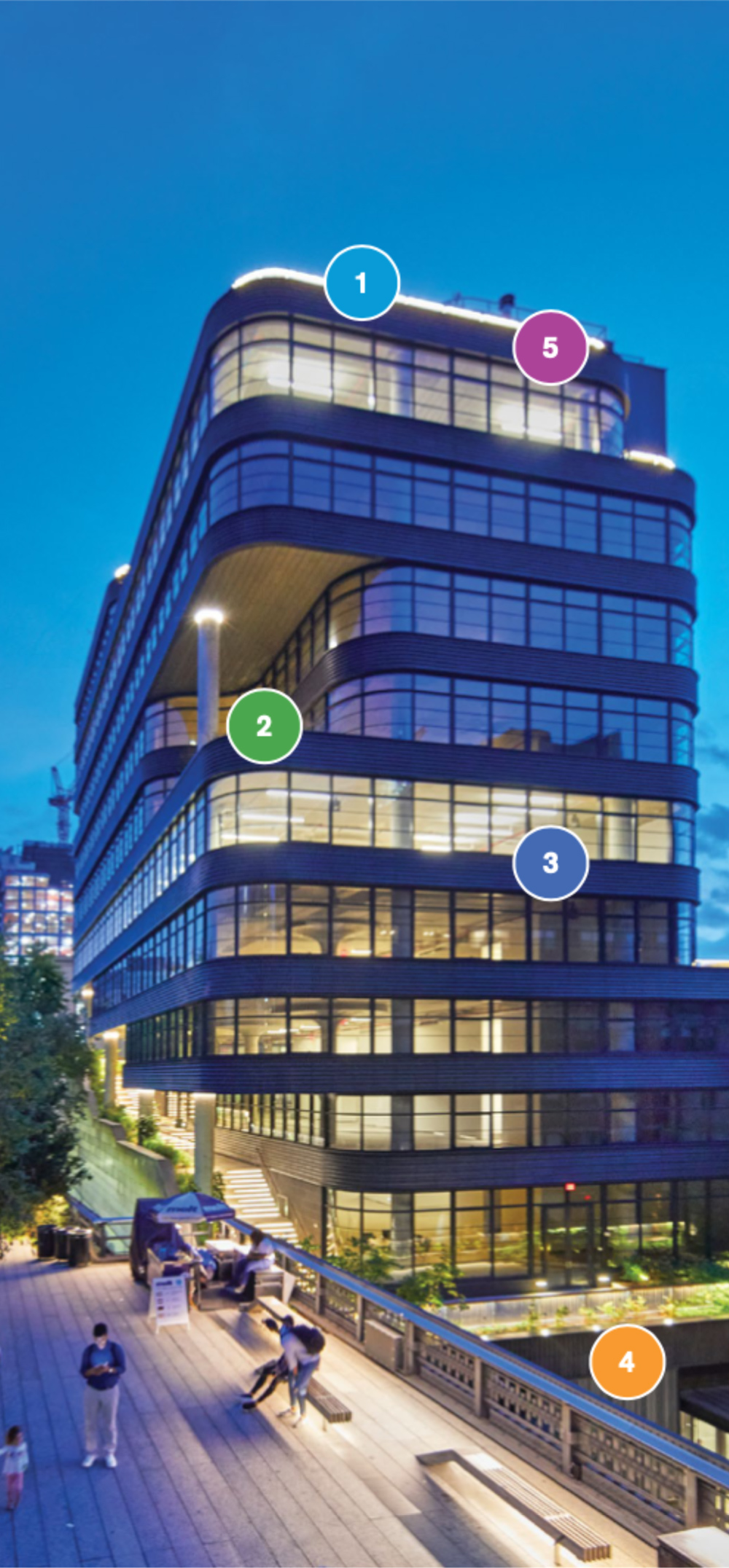

resilience and adaptation

Our properties are located in regions with recent history and future risks of climate-related events. As we assess our exposure to climate risk under varying scenarios, we understand that measures in property resilience are measures in adaptation. Our property at 512 West 22nd Street exemplifies how our new building design is resilient and adaptive to future climate conditions.

At 512 West 22nd Street, we placed all critical mechanical equipment and electrical switchgear above grade to avoid flood damage.

Our new roof landscape systems are designed to absorb and retain stormwater and to slow runoff into the urban landscape and surrounding infrastructure. Green and white roofs also insulate our buildings; reduce current and future demand for heating and cooling; and contribute to heat island reduction, which provides local relief to surface temperature.

Our new glazing and envelope systems are designed to withstand heavy wind and ice conditions. They also are designed to reduce solar heat gains and improve insulation values to minimize heating and cooling demand.

When a new building is located in a flood zone, we anchor temporary walls and venting systems inside our building lobbies to accommodate storm surges and floods and their associated water pressure build-up without damaging the building. At our existing buildings, we install temporary exterior barriers to prevent floodwater from touching the building envelope.

We install backup generation to support, at minimum, fire and life safety systems, as well as critical infrastructure. At 512 West 22nd Street, we have connected our elevators, lighting, and HVAC systems to backup generation systems to ensure safe and secure evacuation in the event of an outage.

512 West 22nd street exterior

Entrance of 512 West 22nd street

Adjoining stairway

Rooftop garden